Commercial mortgages are an integral part of the real estate industry, providing essential funding for commercial properties. The commercial mortgage market in the United States is set to undergo significant shifts in 2024, influenced by various economic conditions, market trends, and technological and regulatory factors. As businesses and investors navigate this evolving environment, understanding the key trends and insights can help them make informed decisions. In recent years, the increasing competition among commercial mortgage lenders has led to more options and flexibility for borrowers

Market Overview

The commercial mortgage market in the USA has shown resilience despite economic uncertainties and global disruptions. The market is expected to continue its growth trajectory, driven by a robust economy, increasing commercial real estate activities, and favorable interest rates.

In 2024, commercial mortgage borrowers can benefit from a range of financing options tailored to their specific needs. Whether it’s financing for property acquisition, refinancing, or property development, there are various solutions available in the market. Borrowers need to assess their requirements and work with a lender that offers flexible and competitive financing options.

Key Drivers:

- Economic Growth: The US economy is projected to grow moderately, with GDP growth stabilizing. This growth is expected to bolster business expansion and commercial real estate investments.

- Interest Rates: Although interest rates are likely to experience slight increases, they remain relatively low by historical standards, encouraging borrowing and investment.

- Urbanization and Infrastructure Development: Continued urbanization and government initiatives for infrastructure development are likely to boost demand for commercial properties, thereby increasing mortgage activities.

Emerging Trends

Several trends are shaping the commercial mortgage market in 2024:

- Technology Integration: The adoption of technology in the mortgage industry is accelerating. Digital platforms and fintech solutions are streamlining the loan application and approval processes, making it easier for borrowers to access financing. Technologies such as AI and blockchain are enhancing transparency, reducing fraud, and improving operational efficiency.

- Green Financing: Sustainability is becoming a critical consideration in commercial real estate. Lenders are increasingly offering green mortgages that finance environmentally friendly projects. These loans often come with favorable terms and incentives for adopting sustainable practices, reflecting a broader shift towards environmental responsibility.

- Diversification of Lenders: The commercial mortgage market is witnessing a diversification of lenders. Alongside traditional banks, non-bank lenders, private equity firms, and real estate investment trusts (REITs) are becoming significant players. This diversification provides borrowers with more options and fosters competitive interest rates.

- Increased Demand for Multifamily Properties: Multifamily properties continue to be a hot segment in the commercial real estate market. Factors such as urbanization, changing lifestyle preferences, and housing affordability issues drive demand for rental properties, leading to robust mortgage activities in this sector.

Challenges

Despite the positive outlook, the commercial mortgage market faces several challenges:

- Regulatory Changes: Changes in regulatory policies can impact the availability and terms of commercial mortgages. Borrowers and lenders must stay abreast of regulatory developments to navigate compliance requirements effectively.

- Economic Uncertainty: Global economic uncertainties, including potential recessions and geopolitical tensions, can affect investor confidence and market stability. Lenders and borrowers need to be prepared for potential market fluctuations.

- Rising Construction Costs: Increasing construction costs due to supply chain disruptions and labor shortages can impact the feasibility of new commercial projects. This, in turn, can affect mortgage demand and loan performance.

Role of Commercial Mortgage Brokers

In this complex and evolving market, the role of commercial mortgage brokers is becoming increasingly vital. A commercial mortgage broker acts as an intermediary between borrowers and lenders, helping clients find the best financing options tailored to their needs.

Benefits of Using a Commercial Mortgage Broker:

- Expertise and Guidance: Brokers have in-depth knowledge of the market and can provide valuable insights and advice to borrowers.

- Access to a Wide Network: Brokers have access to a broad network of lenders, including those not directly accessible to borrowers, ensuring more competitive rates and terms.

- Streamlined Process: Brokers handle the paperwork, negotiations, and coordination, making the loan process more efficient and less stressful for borrowers.

Spotlight on BridgeWell Capital, LLC

When it comes to commercial mortgage financing, it’s essential to work with a reputable and experienced lender. BridgeWell Capital, LLC has proven itself to be a reliable partner for businesses and investors seeking commercial mortgages. Their expertise, personalized approach, and commitment to client satisfaction have set them apart in the industry.

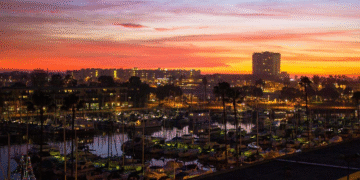

BridgeWell Capital, LLC, one of the best Private Money Lenders based in Orlando, Florida, has established itself as a trusted provider of private money loans, including commercial mortgages. With a track record of funding over $500 million in loans, the company offers a range of financing solutions tailored to the needs of real estate investors and businesses.

Why Choose BridgeWell Capital, LLC:

- In-House Private Capital: BridgeWell Capital uses its own capital for lending, ensuring faster approvals and closings compared to traditional lenders.

- Competitive Rates: They offer some of the lowest investment loan rates in the industry, making them a cost-effective choice for borrowers.

- Diverse Loan Programs: From fix-to-flip to rental and multi-family loans, and commercial real estate bridge loans, BridgeWell Capital provides various loan programs to meet different investment needs.

- Customer-Centric Approach: Known for excellent customer service, supports clients with professional investment coaches and a seamless loan process.

Conclusion

The commercial mortgage market in the USA is poised for growth in 2024, driven by economic stability, technological advancements, and evolving investment trends. Borrowers can benefit from the competitive landscape by staying informed about market trends, leveraging the expertise of commercial mortgage brokers and choosing reliable lenders like BridgeWell Capital, LLC. With its diverse loan programs, competitive rates, and customer-focused service, BridgeWell Capital is well-positioned to support the financing needs of real estate investors and businesses in this dynamic market.