The realm of commercial property investment continues to allure investors seeking to diversify their portfolios and generate stable returns. The landscape of this investment opportunity is diverse, encompassing a range of property types, locations, and investment strategies. Understanding the nuances and potential of commercial property investment is crucial for those looking to capitalise on this asset class.

The Appeal of Commercial Property Investment

Commercial property investment offers several advantages over other investment forms. Firstly, it can provide investors with a steady income stream through rental earnings. Additionally, unlike residential real estate, commercial leases often span longer terms, offering investors greater certainty over future cash flows. Furthermore, commercial properties tend to be less prone to the volatility seen in stock markets, resulting in a less tumultuous investment experience.

Diverse Portfolio of Opportunities

Investors have a plethora of choices within the commercial property sector, from office buildings and retail spaces to industrial warehouses and multi-use complexes. Each type of commercial property comes with its unique set of demand drivers, risks, and rewards. For instance, retail spaces may benefit from high foot traffic in urban centres, while industrial properties could be favoured by developments in logistics and e-commerce.

The Importance of Location

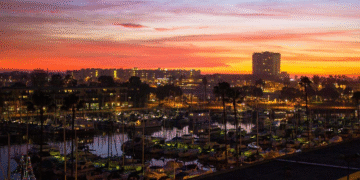

Location is a key determinant in the success of a commercial property investment. Key considerations include accessibility, local economic growth, and the supply-demand balance for commercial spaces in the area. A property situated in a burgeoning business district or a region experiencing an infrastructure boom can lead to substantial capital appreciation and robust rental yields.

Assessing Investment Strategies

Commercial property investment strategies range from direct ownership to indirect investment through real estate investment trusts (REITs) or property funds. Direct investment allows for more control and potential for higher returns but usually requires significant upfront capital and expertise in property management. Conversely, REITs and property funds enable investors to gain exposure to commercial real estate with less capital and less hands-on management.

Understanding Risk Factors

As with any investment, commercial property carries its set of risks. Market fluctuations, changes in tenancy laws, and evolving consumer habits can all impact the performance of commercial real estate. Additionally, properties may face vacancies, unexpected maintenance issues, and shifts in the local economic landscape that could affect their profitability.

Navigating the Investment Journey

For novices and seasoned investors alike, navigating the commercial property market requires solid research, due diligence, and often, the guidance of experienced professionals. Engaging a commercial property investment consultant can provide invaluable insights into market trends, property valuations, and tailored investment strategies. Such expertise can help investors make informed decisions and mitigate potential risks.

Long-term Perspective

Commercial property investment often demands a long-term perspective. The acquisition and subsequent disposal of properties can span several years, during which market conditions may shift significantly. As such, investors need to remain agile, adapting their strategies to align with the evolving market and economic trends.

Financial Considerations

Financing commercial real estate typically involves larger sums than residential properties, influencing loan-to-value ratios, interest rates, and lending terms. Investors must carefully assess their financing options and capital structure to ensure their investment is sustainable and aligned with their financial objectives.

Role of Economic and Political Factors

Economic and political climates play critical roles in the performance of commercial property investments. Interest rates, tax regulations, and government policies concerning business growth and property development can all contribute to the attractiveness of commercial properties as investment vehicles.

Market Analysis and Timing

Timing the market and understanding cyclical patterns are important in maximising returns from commercial property investments. Recognising the phase of the property cycle – be it growth, stabilisation, decline, or recovery – allows investors to purchase at advantageous prices and potentially sell when the market peaks.

Environmental and Social Governance (ESG)

Increasingly, investors are focusing on environmental and social governance (ESG) factors when assessing commercial property investments. Properties that adhere to sustainability standards, promote energy efficiency, and contribute positively to the surrounding community can attract a premium in the market, bolstering both their tangible and intangible value.

Technological Impacts

Technological advancements are reshaping the commercial property landscape. The rise of smart buildings, the necessity for high-speed connectivity, and the growing trends towards flexible workspaces are influencing tenant demand and investment potential. Keeping abreast of these trends is critical for future-proofing commercial property portfolios.

Conclusion

The dynamic nature of commercial property investment provides plentiful opportunities for investors to build wealth and generate income. However, success in this field requires a comprehensive understanding of the market, careful planning, and a proactive approach in managing assets.

Whether you are eyeing prime office space, a bustling retail centre, or an expansive industrial complex, the landscape of commercial property investment is ripe with possibilities. With the right strategy and support from expert consultants, investors can navigate this complex but rewarding terrain to realise their financial aspirations.